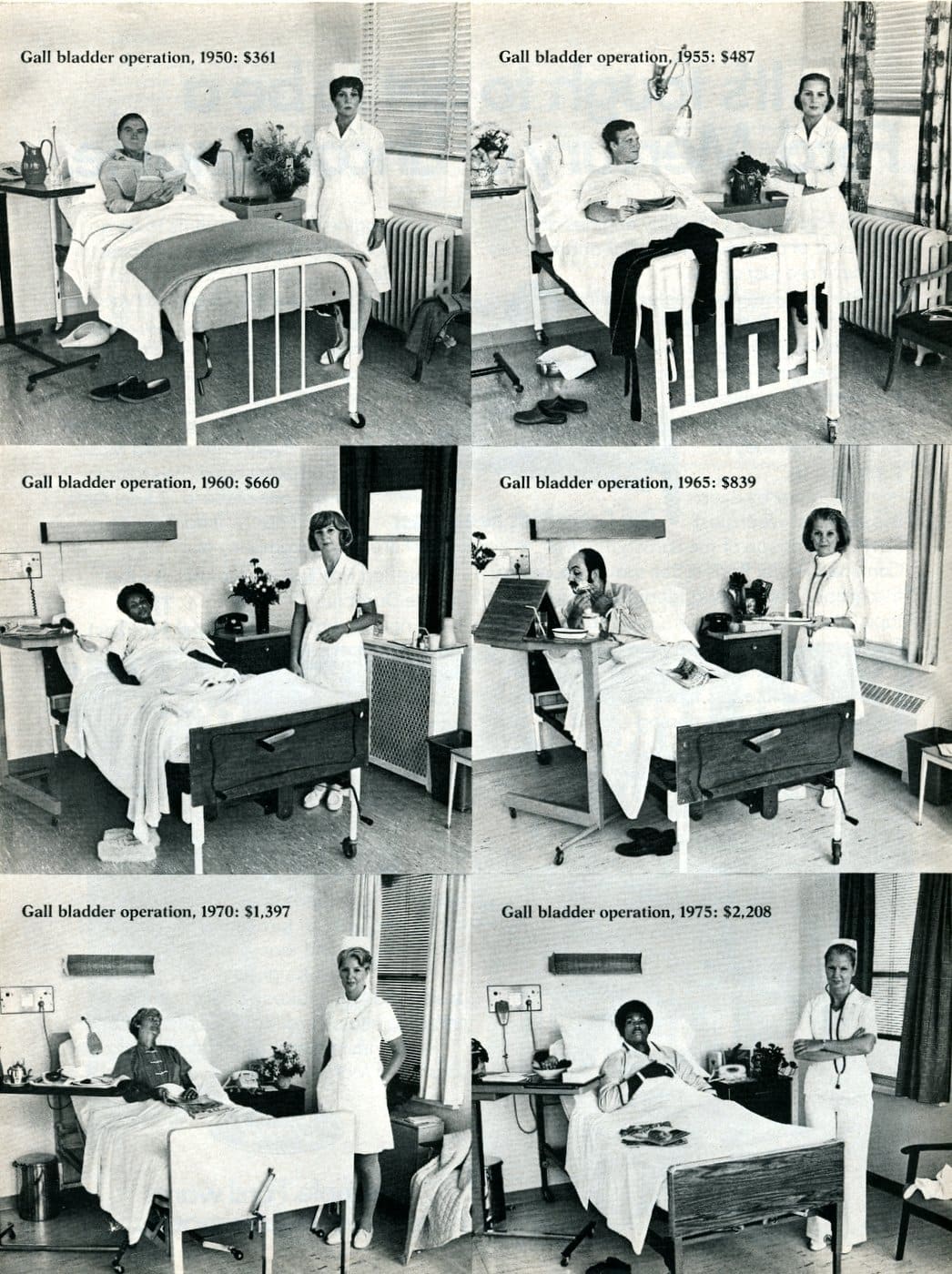

When we visit healthcare professionals, we don’t typically think of ourselves as “consumers” or buyers of health care — but in these tough times, that is precisely the role a patient needs to play to avoid drowning in a sea of medical bills.

What are the best strategies for haggling with your doctor or hospital? First, let’s take a look at why medical charges are such a problem.

Many people simply can’t afford their medical bills

A full 2/3 of consumers are worried about their ability to pay for their medical expenses, according to a 2021 survey commissioned by AccessOne, a provider of patient financing solutions for healthcare costs.

The Access One survey found that across generations, millennials and Gen Xers are most concerned that they will be unable to pay for their care, with 53% of millennials and 46% of Gen Xers stating they are very or somewhat concerned about their ability to cover their cost of care.

Confusion can add to the problem

The potential inability to pay for services rendered isn’t the only problem: sometimes the water is muddied by the ways healthcare providers, hospitals, surgery centers and clinics charge patients.

In an investigative report on confusing medical billing practices published in 2018, Consumer Reports magazine found that “hospital, doctor and insurance bills are riddled with incorrect or unexpected charges are surprisingly common.”

The report found that because medical bills themselves are so confusing — filled with specialized terms, and lacking clarity about whether patients or their insurer is responsible for payment — millions of Americans actually give up trying to fight them.

That same survey found that more than 1/3 of people who responded had paid medical bills they weren’t sure that they owed — and 20% of that group paid more than $1,000 for questionable charges.

Why? Several reasons: People said that the bills were too confusing, they were uncertain their efforts would make a difference, and people were concerned not paying would hurt their credit record.

Overwhelmed patients often don’t know where to turn

“Americans are overwhelmed by health costs and many people simply can’t pay their bills, can’t afford their medications,” says John Santa, MD, MPH., director of the Consumer Reports Health Ratings Center.

“The last thing most patients want to do is haggle with their doctors, but a little bit of negotiating can go a long way. It’s also important to know that there are tremendous variations in health care costs — knowing this can help a consumer get a hand up and politely insist on the fairest possible price.”

Here’s Consumer Reports’ advice for three possible scenarios:

Save on medical bills: When you’re healthy

The optimal time for patients to talk with their healthcare providers about costs is before any have been incurred. While doctors have a professional obligation to take a patient’s financial resources into account, patients should raise the issue with their doctors to let them know that costs are important to them.

“For a variety of reasons, doctors are likely to suggest the most expensive options first. But you might be surprised by your doctor’s willingness to change course, for example prescribing fewer expensive brand name drugs, or choosing watchful waiting over a costly diagnostic test,” Dr Santa says.

Save on medical bills: When the unexpected occurs

A patient lands in the hospital without the benefit of any planning and gets slammed with a huge bill, say $15,000 for a coronary angiogram, and insurance ends up covering only a fraction of the bill. Consumer Reports recommends these approaches to get the greatest reduction to their bill:

Sit down with the medical professional who ordered or performed the hospital services to find out how the hospital costs ran so high.

Were all the services needed and reasonably priced? Consumers can judge for themselves by checking healthcarebluebook.com, which lists the going rates for many medical services. Closely examine each bill to identify errors, which are common.

People should not assume the price on their bill is set in stone. Providers often discount rates substantially to insurers and others, so why shouldn’t a consumer ask for the same rate reduction? Patients should dispute any charges they think their insurance company ought to cover.

Patients should not pay their bill until they have exhausted all of their options, but they should make clear to the hospital’s billing department that reaching a resolution is important to them. They might consider making a discounted offer that they think would be manageable within a set time period.

Consumers can consult one of the reputable groups that, for a fee, can help reduce the size of medical bills, such as MedWise Insurance Advocacy, and Medical Cost Advocate).

Save on medical bills when you’re having an elective surgery

When you’re having elective surgery, the situation allows for more planning and research into the best procedure, doctor, hospital, drug or any other options.

“Use your time wisely to do the research, because variations in health-care costs can be significant, and providers will gladly let you overpay for a service that you could get for less,” says Dr Santa.

Keep in mind the following advice:

Shop around, talk to different providers, and bargain for what they think is a fair price.

Don’t hesitate to ask for the price upfront and get it in writing. Request an itemized list of all potential charges.

As with any purchase, beware of any offer that sounds too good to be true. If a provider suggests a shortcut, be wary and ask a lot of questions, and check out providers that are unfamiliar.